In order to comply with regulations regarding subcontracting of specialized services, the Ministry of Labor and Social Security (STPS) implemented as of May 25, 2021 the Registry of Providers of Specialized Services or Works (REPSE) as a requirement for those individuals and entities providing said services.

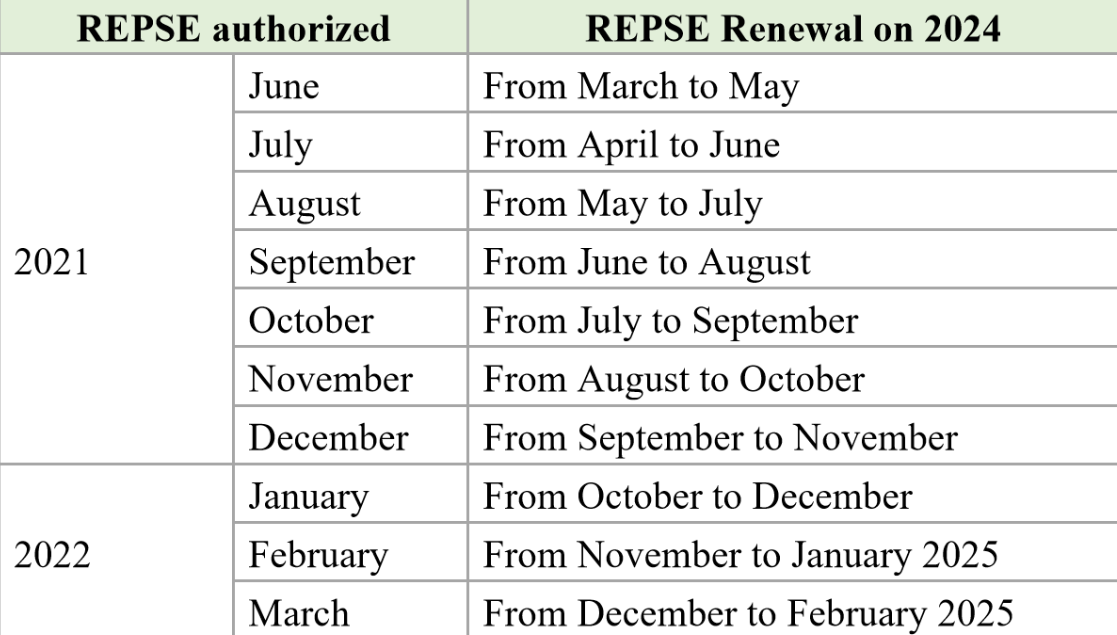

The REPSE will be valid for 3 years from the first registration, regardless of whether an update or modification was made and its renewal application must be filed according to the calendar published by the STPS based on the year and month of its original registration.

The REPSE platform will enable a section named «Registration Renewal» only for the period authorized for it; thus, in this year 2024, the REPSE authorized back in 2021 and 2022 must be renewed on the following dates:

Therefore, the renewal process must be filed on time in order to be compliant and to provide recipients of specialized services such renewed registration under their respective contracts. Otherwise, failure to comply could trigger the following legal consequences:

- Cancelation of the REPSE and the lawful provision or receipt of specialized services;

- Imposition of fines up to $5,428,500.00 pesos (approx. USD$310,000) for providing or receiving specialized services without a valid REPSE;

- Risk of triggering a tax evasion offense under criminal regulation;

- Challenges from the Tax Authority over intended deductions or credits for invoiced amounts related to specialized services.

For any additional information and legal advice on how to conduct the renewal process and REPSE regulation in general, please contact the attorneys of our labor-tax practice group: